Whether you’re preparing for retirement, running a business, or building a plan for future generations, we help you connect the dots. Everything we offer is built to simplify your decisions, not overwhelm them.

We build and manage portfolios that reflect your goals—not someone else’s sales incentives. You'll get a clear investment plan with ongoing management and regular updates so you always know how things are performing.

We help reduce the tax drag across your investments, income, and distributions. Our planning includes capital gains strategy, charitable planning, and coordination with your CPA.

Your estate plan should reflect what matters most. We help design practical, tax-smart solutions that make it easier to transfer wealth and leave a lasting impact.

From insurance reviews to asset protection, we help you think through what could go wrong so you can plan with more peace of mind.

METHODOLOGY

A Clear Framework for Every Decision

Traditional financial advice can feel scattered or overly complex. That’s why we use the P.A.T.H. methodology:

We offer a straightforward assessment and follow-up strategy that helps you gain confidence in your plan, spot hidden risks, and find ways to improve your long-term outlook.

We take time to understand your situation, your concerns, and what’s most important to you.

Using our P.A.T.H. framework, we look at everything from investments and taxes to estate and insurance to identify what’s working and what might need attention.

We present a clear strategy, explain the “why” behind each recommendation, and walk through how it will work in real life.

Once you're ready, we put the plan in motion, coordinating with other professionals when needed.

We keep your plan updated with regular check-ins and make adjustments as your life evolves.

SERVICES

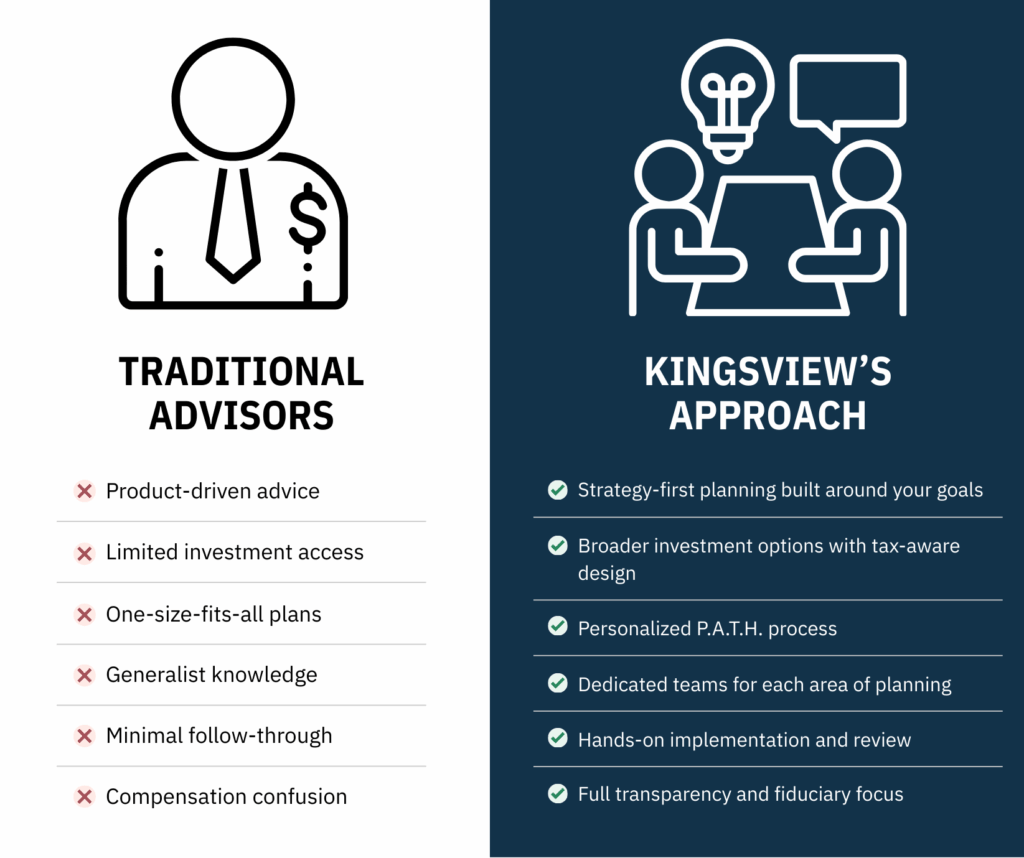

| Traditional Advisor | Kingsview Approach |

|---|---|

| Product-driven advice | Strategy-first planning built around your goals |

| Limited investment access | Broader investment options with tax-aware design |

| One-size-fits-all plans | Personalized P.A.T.H. process |

| Generalist knowledge | Dedicated teams for each area of planning |

| Minimal follow-through | Hands-on implementation and review |

| Compensation confusion | Full transparency and fiduciary focus |

INSIGHTS

Putting clients first means more than meeting a fiduciary standard. It means knowing you, understanding your goals, and treating you like a person.

Discover where you stand on the path to retirement confidence with our institutional-quality assessment tool.

INTERACTIVE QUIZ | 5-Minutes

Discover where you stand on the path to retirement confidence with our quiz but comprehensive self-assessment tool.

DOWNLOADABLE GUIDE | 22 Pages

You’ve saved for decades. But when retirement hits, an unexpected chain reaction could trigger a retirement tax bomb…

INTERACTIVE QUIZ | 5-Minutes

Discover where you stand on the path to retirement confidence with our quiz but comprehensive self-assessment tool.

DOWNLOADABLE GUIDE | 18 Pages

How much do you really need to retire? Cut through the guesswork and calculate a target that’s built around you.

Let’s figure out the best way to move forward — together.

© 2026 KINGSVIEW WEALTH. All Rights Reserved.

Investment advisory services are offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. Insurance products and services are offered and sold through Kingsview Insurance Services, LLC (“KIS”), by individually licensed and appointed insurance agents. KWM and KIS are subsidiaries of Kingsview Partners.